WealthSim (The Personal Finance RPG) Update 4: Real Estate

01 Aug 2015

Eric Fram

This article was originally posted in ZippyBrain.com on August 1st, 2015. Link

Introduction

We’re continuing to make great progress on our current project, WealthSim. If you’re not familiar with the project, feel free to catch yourself up on the update I’ve published so far: Announcement | Update 1 | Update 2 | Update 3.

As of today, we finally have mortgages working in the game. I thought it would be a good time for a post about how real estate works in WealthSim. Right now, there are 11 different houses in the game available for either purchase or rent. When a player rents a property, we don’t really have to do much math. When a player buys a property, though, we need to accurately simulate the mortgage repayment schedule based on the total value of the mortgage and the current in-game interest rates. Other expenses, such as maintenance, insurance, condo fees, utilities and taxes are also simulated.

Right now, property values are static. Eventually, the value of each property will vary with inflation and other factors.

What's on the Market?

There are a wide variety of properties available in WealthSim, from fixer-uppers to beachside estates. (We’re still showing some debug text on the bottom of these screenshots. That will be removed for later versions).

These houses were build using Kenney’s great tilesets.

1294 Colorado Ave. - 2bd, 1 bth - 1,224 sq ft - 0.25 acres | List Price: $172,000 - Great Value!

65 Mountainview Rd. - 2bd, 1bth - 1,048 sq ft - 0.05 acres | List Price: $213,000 - Convenient Freeway!

295 Doubletree Rd - 3br, 1bth - 1,835 sq ft - 0.15 acres | List Price: $315,000 - Convenient Airport!

451 4th St. #304 - 1br, 1bth - 510 sq ft - 3rd floor | List Price: $395,000 - Great Views!

12240 San Vicente Blvd. - 2br, 1bth - 972 sq ft - 0.06 acres | List Price: $450,000 - Good Schools!

6401 Arroyo Verde Dr. #210 - 2br, 1bth - 1,100 sq ft - 2nd floor | List Price: $699,000- Close to Beach!

19128 Sunset Blvd. #1065 - 3br, 3bth - 907 sq ft - 10th floor | List Price: $835,000 - Great Schools & Good Views!

5319 Iowa Road - 3br, 2bth - 1,457 sq ft - 0.13 acres | List Price: $1,350,000 - Ocean Views!

810 24th St. - 5br, 4th, 3,637 sq ft - 0.17 acres | List Price: $3,450,000 - Great Schools & Close to Beach!

10 Century Way #2203 - 6,000 sq ft - 22nd floor | List Price: $7,200,000 - Fantastic Views!

3191 Chautauqua Blvd. - 7bd, 9bth - 7,100 sq ft - 0.47 acres | List Price: $10,450,000 - Great Schools & Fantastic Views!

Let's Buy 12240 San Vicente!

First, we’ll just go to the real estate listings screen and scroll down:

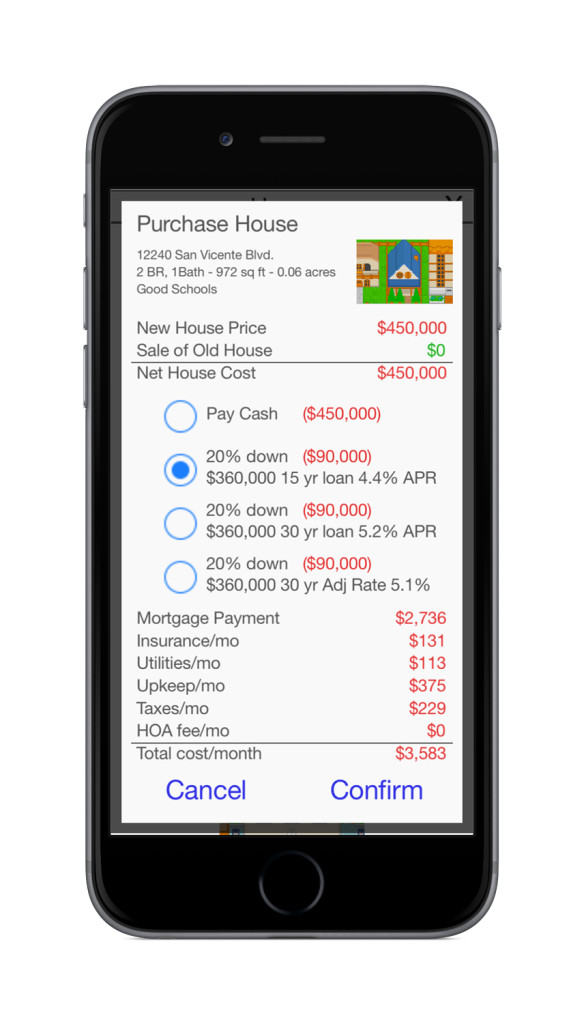

There it is! Now we’ll click the “Buy” button to open up the different options for buying the property:

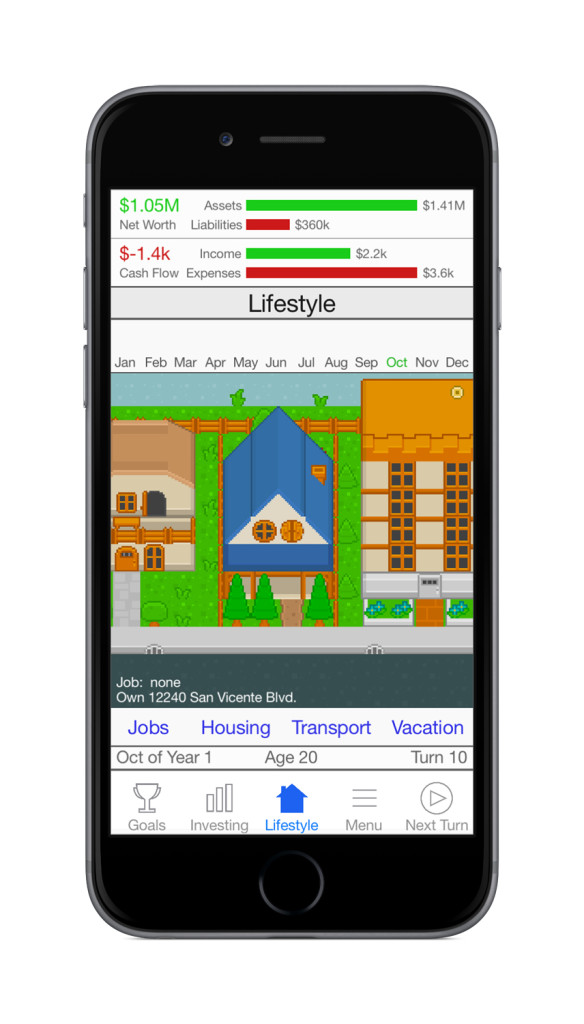

We’ll pick the 15 year mortgage since we’ll pay a lot less total interest. After confirming our purchase, we can go back to the home screen to see our new house (which looks like it might be costing us too much)!

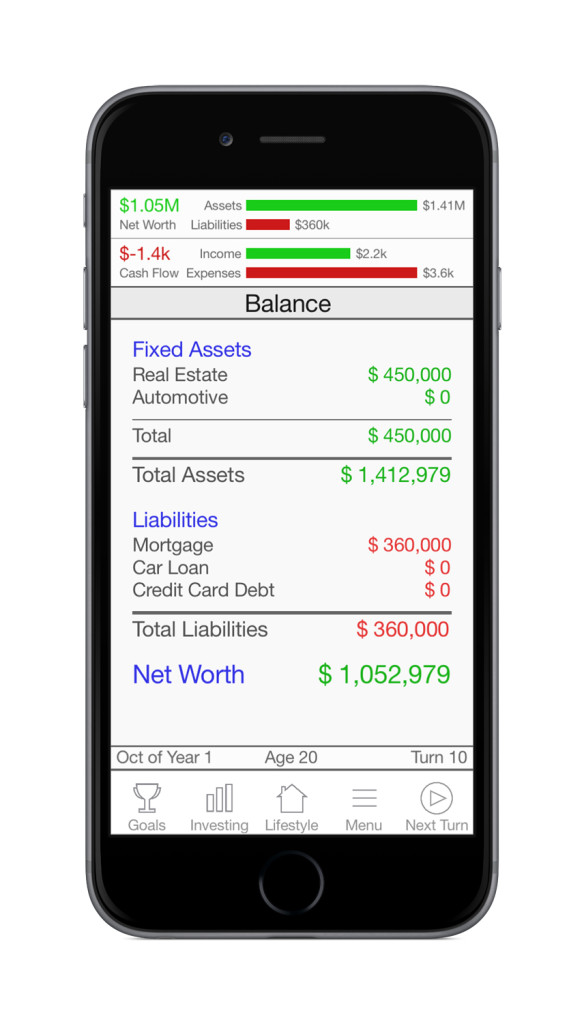

To see the value of our house and to see how much money is left on the mortgage, we can check out balance sheet:

Since each turn is a month, we’ll be making one payment each turn for the next 180 turns/15 years (assuming we don’t buy another house in that time). Our first month’s payment of $2,736 dollars will reduce the mortgage balance to $358,439 ($960 paid in interest). As time passes, we’ll be paying a lot less interest and will reduce our mortgage balance much more quickly. Had we picked a 30 year mortgage, our total monthly payments would be lower, but we’d pay a lot more total interest and it would take us a lot longer to reduce the mortgage balance.

We’re closing in on the user testing stage, so you’ll be able to try this out for yourself soon!

Thanks for checking out this update. Please contact @ZippyBrain with any questions or comments.